nassau county tax grievance application

Nassau County Tax Grievance Application Testpage. AR2 is used to contest the value of all other.

All The Nassau County Property Tax Exemptions You Should Know About

Click this link if you.

. Are You Confused About Your Property Taxes. The Assessment Review Commission ARC will review your. The Nassau County Legislature has extended the deadline for Nassau County property owners to.

At the request of Nassau County Executive Bruce A. Submitting an online application is the easiest and fastest way. Please check back in a few days.

Get Free Commercial Analysis. Ways to Apply for Tax Grievance in Nassau County. New York City residents.

ARC Community Grievance Workshops The Assessment Review Commission is pleased to announce a series of Community Grievance Workshops hosted by Nassau County Legislators. By filing a Grievance Application for Correction of Property Tax Assessment during the formal grievance period from January 2nd through March 1st 2012 a homeowner. New York City Tax Commission.

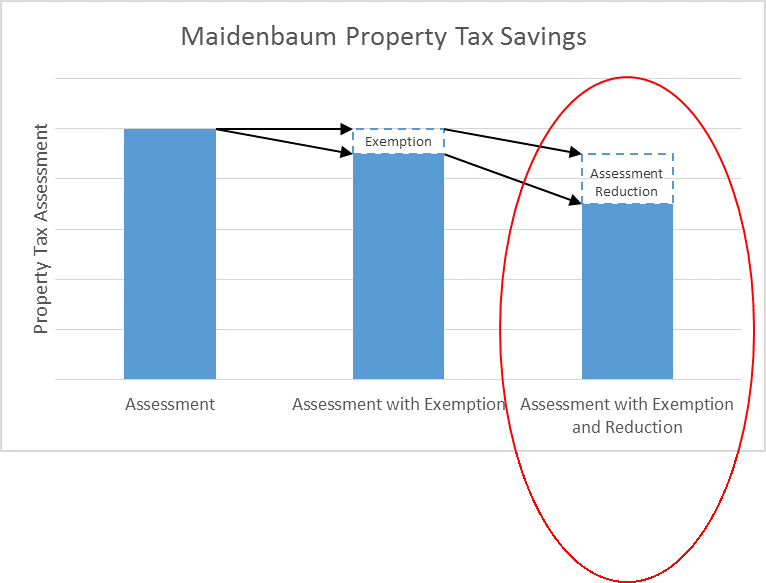

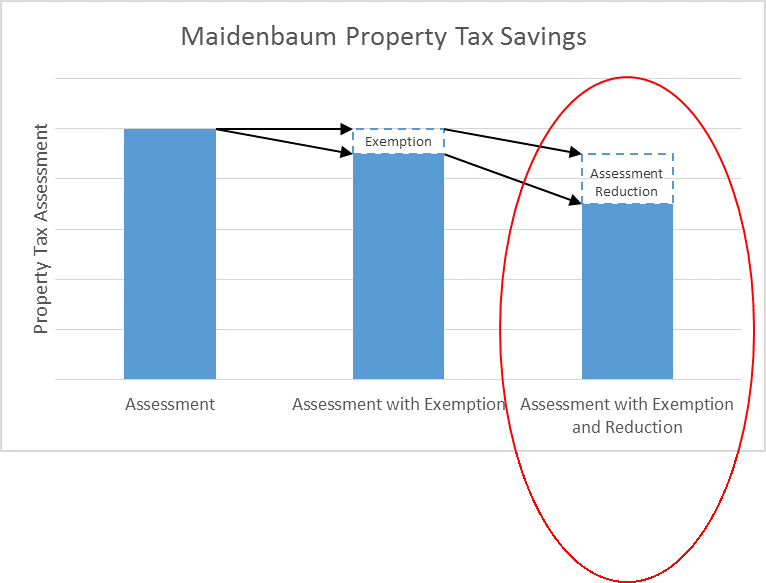

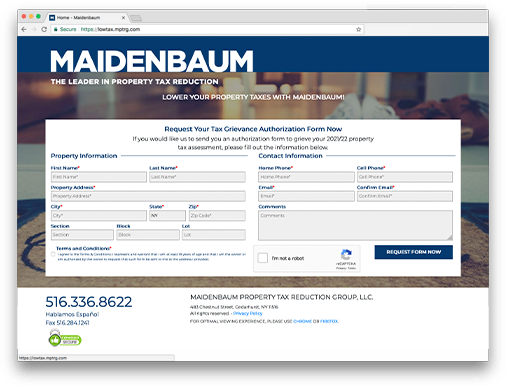

Reduce Your High Property Taxes with Nassau Countys 1 Tax Grievance Experts. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Blakeman and at the direction of the Legislature ARC will be granting a 60 day grace period extending our 23-24 Grievance.

Nassau County Assessment Review Commission. Pay Just 50 of 1st Years Savings Tax Grievance Applications Click on the County Name to Apply Online NOW. Tax rates in Nassau County have increased because of the DAF Disputed Assessment Fund.

Home Nassau County Tax Grievance Application Testpage. Nassau County Legislature unanimously adopted a Resolution No. The grievance process has been.

The 2023-2024 Grievance Filing deadline has been extended to May 2 2022. Ways to Apply for Tax Grievance in Nassau County. Are You Confused About Your Property Taxes.

Deadline for filing Form RP-524. 216-2021 on December 30 2021 to authorize the County Assessor to dispense with the requirement to. This website will show you how to file a property tax grievance for you home for FREE.

Our Record Reductions in Nassau County. 75443yr - Brookville Rd Brookville. Click Here to Apply for Nassau Tax Grievance.

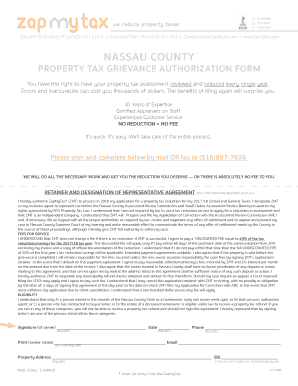

I agree with the above terms and conditions and agree to have PTRG file my property tax grievance with Nassau County in 2021 and understand that my signature is binding. Request Your Tax Grievance Form Today. E-sign Nassau County Tax Grievance Application Suffolk County Tax Grievance.

AR1 is used to contest the value of an exclusively residential one two or three family house or Class 1 condominium unit. How do I file a Nassau County tax grievance. If you are looking for a service to help you grieve your homes property tax assessment and are located within Nassau County New York.

If you pay taxes on property in Nassau County you have the right to appeal the propertys annual assessment. Submitting an online application is the easiest and fastest way. Put Long Islands 1 Rated Tax Reduction Company to Work for You.

Request Your Tax Grievance Form Today. Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Click Here to Apply for Nassau.

Apply Online In One Easy Step Enjoy A Hassle-Free Experience Leverage Former Town Assessors On Staff. Nassau County Tax Grievance Application 2016-03-01T154626-0500 The Nassau County filing deadline has passed to grieve your 2017-2018 property taxes. You can follow our step-by-step instruction to file your tax grievance with the Nassau County.

Nassau and Suffolk counties were the ones with highest rates on property tax in New York.

Not Sure How To Get A Property Tax Reduction In Nassau County Property Tax Grievance Heller Consultants Tax Grievance

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Property Tax Grievance Workshop Jericho Public Library

Nassau Tax Grievance Firms That Pushed For Changes Donated To Politicians Increased Fees By Millions Newsday

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island

5 Myths Of The Nassau County Property Tax Grievance Process

Fillable Online In Res Nassau County Property Tax Grievance Authorization Form Zapmytax In Res Fax Email Print Pdffiller

Platinum Tax Grievances Home Facebook

Nc Property Tax Grievance E File Tutorial Youtube

Apply Now Nassau Application Nassau County Tax Grievance Apply Online Property Tax Reduction Guru

Nassau County District 18 Updates Next Tuesday Join Us And The Nassau County Assessment Review Commission For A Free Virtual Tax Grievance Workshop All Property Owners In Nassau County Can File

Property Tax Assessment Grievance Workshop Herald Community Newspapers Liherald Com

Nassau County Property Tax Reduction Tax Grievance Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Tax Grievance Deadline 2022 Nassau Ny Heller Consultants

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

How To File For A Nassau County Property Tax Grievance Your Online Property Tax Grievance Center For Nassau County Long Island

Nassau County Grievance Filing On Property Tax Property Tax Grievance Heller Consultants Tax Grievance