capital gains tax increase effective date

The Tax Policy Center found that capital gains realization increased by 60 before the capital gains tax was increased from 20 to 28 by the Tax Reform Act of 1986 effective in 1987 and by 40 in 2012 in anticipation of the increased maximum tax rate from 15 to 25 in 2013. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

How Do State And Local Individual Income Taxes Work Tax Policy Center

The proposal would increase the maximum stated capital gain rate from 20 to 25.

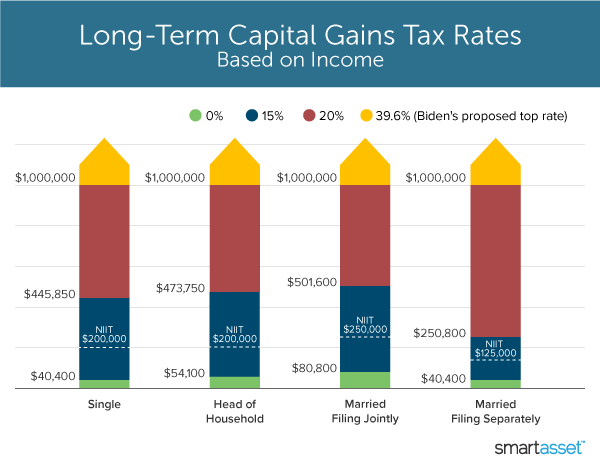

. 1 2022 with some exceptions he said. According to a House Ways and Means Committee staffer taxpayers who earn more than 400000 single 425000 head of household or 450000 married joint will be subject to the highest federal tax rate beginning in 2022. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income.

The relevant legislation is contained in the Eighth Schedule to the Income Tax Act 58 of 1962. 27 deadline there could be imminent action triggering an effective date tied to an upcoming date. We are the American Institute of CPAs the worlds largest member association representing the accounting profession.

Effective Date Considerations KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. Capital gains are taxed. On Friday May 28 2021 the Biden Administration released its Green Book setting out the Presidents revenue and policy proposals.

9 and racing against a Sept. In addition to raising the capital-gains tax rate House Democrats legislation would create a 3 surtax on individuals modified adjusted gross income exceeding 5 million starting in. With tax writers launching mark-ups as early as Sept.

Dems eye pre-emptive capital gains effective date. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. Capital Gains Tax Rate 2022.

The proposal would be effective for gains recognized after the undefined date of. Capital gains tax rates on most assets held for less than a year correspond to. Today youll find our 431000 members in 130 countries and territories representing many areas of practice including business and industry public practice government education and consulting.

An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate. And capital gains because they target sales and exchanges each one of those policies may be appropriate for an exception. President Joe Biden released his proposed 2022 fiscal year budget on Friday which calls for an increase of the top capital gains tax rate to 396.

Its time to increase taxes on capital gains. Historically capital gains tax has sat around 20. Among other things the bill would increase the individual ordinary income tax rate from 37 to 396 increase the capital gains rate from 20 to 25 expand the application of the 38 surtax on net investment income introduce a new 3 surcharge on those with income over 5 million reduce in half the exclusion of gain from the sale of.

Democrats have made an increase in the capital gains rate a major priority in their upcoming reconciliation tax bill and the potential effective date is critical for many investment decisions. Top earners may pay up to 434 on long-term. Bidens Capital Gains Proposal.

House democrats propose raising capital gains tax to 288 published mon sep 13 2021 333 pm edt updated mon sep 13 2021 406 pm edt greg iacurci gregiacurci. The effective date for this increase would be september 13 2021. Tax on capital gains would be increased to 288 per cent by House Democrats.

The current estimate of that effective date ranges from October 15 2021 on the early. A capital gain arises when you dispose of an asset on or after 1 October 2001 for proceeds that exceed its base cost. Bidens plan would raise the top tax rate on capital gains to 434 from 238 for households with income over 1 million.

In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. Of particular interest to investors is the administrations proposal to raise the tax on long-term capital gains from its current maximum rate of 238 percent including the 38 percent net investment income tax to a new rate of 408. It is expected that the long-term capital gains tax rate change will be effective the day it is agreed to and announced with little to no advance warning.

The effective date for this increase would be September 13 2021. Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. Ive always been thinking in discussing Biden tax policy assuming we have legislative activity this year we would be looking at an effective date of Jan.

Should the proposals become law your client will now pay federal capital gains tax of 740000 in 2021 and 792000 in 2022 and 2023. Specifically the Greenbook proposes to tax long-term capital gains and qualified dividends of taxpayers with adjusted gross income of more than 1 million at ordinary income rates with 37 percent being the highest rate 408 percent including the net investment income tax. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of.

Our history of serving the public interest stretches back to 1887. This is a total of 1124000 additional tax.

Pin By Tina On Irs In 2022 Irs Taxes Capital Gains Tax Tax Brackets

Capital Gains Tax What Is It When Do You Pay It

Q A What Is Capital Gains Tax And Who Pays For It Lamudi

2022 And 2021 Capital Gains Tax Rates Smartasset

4 Best Investment Options Findoc Group Investing Best Investments Financial Services

Capital Gains Yield Cgy Formula Calculation Example And Guide

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

What S In Biden S Capital Gains Tax Plan Smartasset

Ultimate Guide To Capital Gains Tax Exemption U S54 In A Video Watch It To Know About It Capital Gain Capital Gains Tax Gain

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

2022 And 2021 Capital Gains Tax Rates Smartasset

Harpta Maui Real Estate Real Estate Marketing Maui

How To Open Capital Gains Account In India In 2022

2022 And 2021 Capital Gains Tax Rates Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset

What S In Biden S Capital Gains Tax Plan Smartasset